On this page you will read detailed information about What Is an LLC Operating Agreement?.

As an entrepreneur, you know that forming a limited liability company (LLC) provides benefits like limited personal liability and pass-through taxation. However, simply filing your articles of organization does not provide guidelines for running your business. An operating agreement establishes rules that govern how your LLC will function and is just as vital as your formation documents. In this 100-word article, you will learn key details about LLC operating agreements: what they are, why you need one, what it should include, options for creating your own, and how an operating agreement supports the overall success of your company. Understanding operating agreements empowers you to build a strong foundation as an LLC owner.

What Is an LLC Operating Agreement?

An LLC operating agreement is a legal document that outlines the ownership and member responsibilities of a limited liability company (LLC). Though not required in all states, creating an operating agreement is highly advisable for any LLC. It helps establish structure, prevents disputes between members, and protects your liability.

Establishes Structure

An operating agreement specifies how your LLC will be organized and run. It designates the percentage of ownership each member has, how profits and losses are distributed, how the business will be managed, voting requirements, meeting schedules, and more. This structure helps create clear expectations and ensures all members are on the same page regarding their rights and responsibilities.

Prevents Disputes

With an operating agreement in place, all members understand their roles and obligations to the LLC. This can help avoid confusion and conflict over issues like:

- Financial contributions and distributions

- Daily responsibilities and management duties

- Adding or removing members

- Amending the operating agreement

By mapping out these details upfront, members can refer to the document to resolve any questions or disagreements that arise.

Protects Your Liability

An operating agreement also establishes that your LLC is a separate legal entity from its members. This is important because it helps shield members from personal liability for business debts and lawsuits. However, if challenged in court, the lack of an operating agreement could put your liability protection at risk. The agreement shows you have taken steps to formally organize your LLC.

In summary, an LLC operating agreement is a vital document that provides legal and practical benefits for your business. Though operating agreements are flexible and can be amended or terminated, crafting one upfront establishes a foundation for your LLC to build upon. Speak with an attorney to ensure your agreement abides by your state’s laws and meets the needs of your unique business.

In the previous post, we had shared information about What Is a Trademark? Defining This Important Branding Term, so read that post also.

Why You Need an Operating Agreement for Your LLC

An operating agreement is a legally binding document that outlines the rules and regulations for your LLC. Creating an operating agreement is not required by law, but it is highly advisable to have one in place. Here are a few reasons why an operating agreement is essential for your LLC:

Define Ownership and Management Structure

An operating agreement specifies the ownership interests of each member, as well as how the business will be managed. It details the rights and responsibilities of both members and managers. This helps avoid confusion and conflict over who controls the company and its assets.

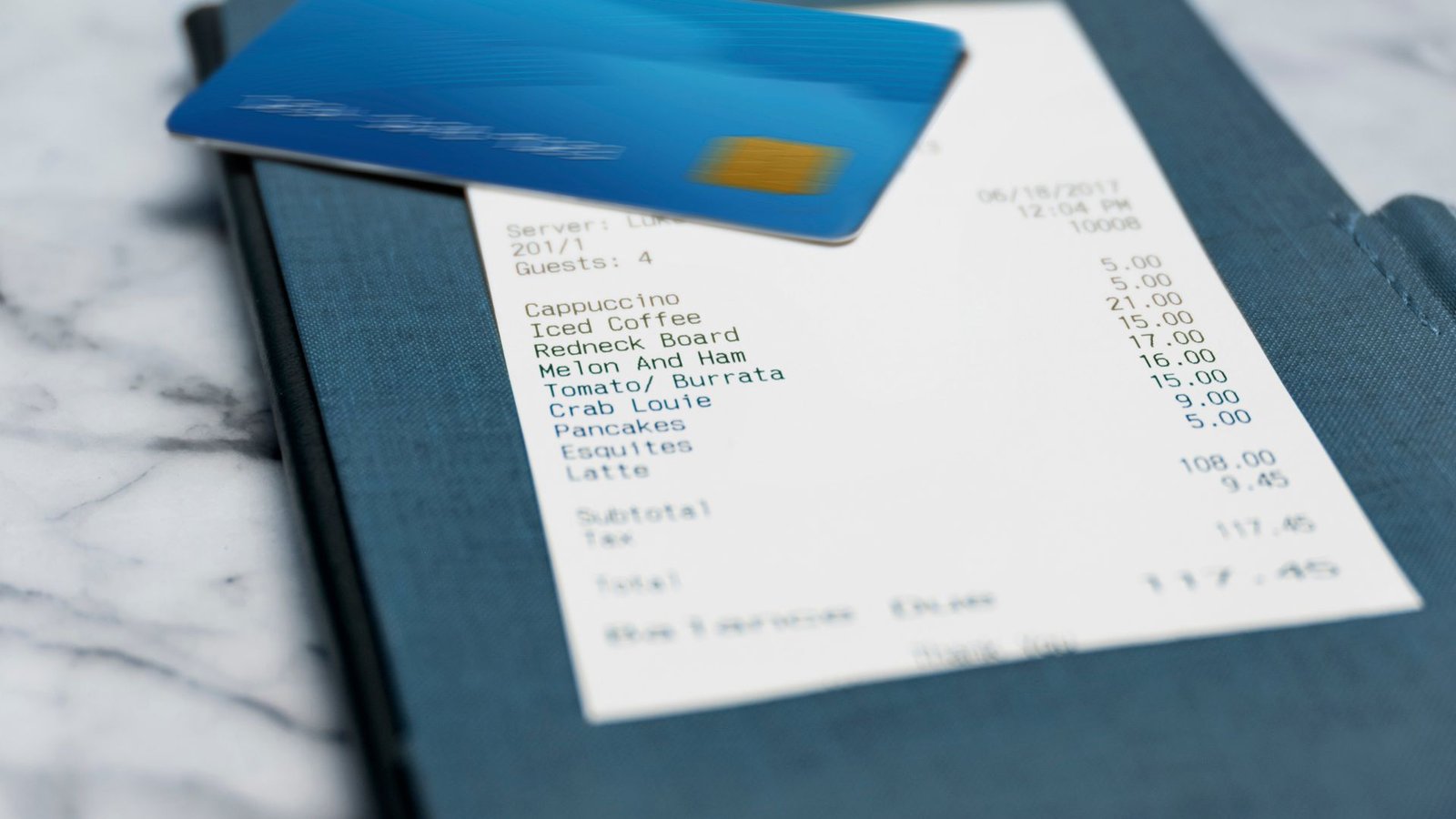

Spell Out Financial Rights and Obligations

The operating agreement establishes how profits and losses will be distributed, as well as the process for making capital contributions and distributions. It also sets the members’ rights to the LLC’s assets if the company is dissolved. These provisions provide protection for all parties involved and help ensure the financial security of the LLC.

Set Ground Rules for Your LLC

An operating agreement establishes rules around meetings, voting, new membership interests, transferability of membership interests, record keeping, and other standard procedures. These ground rules help facilitate orderly and productive operations of the LLC. They provide a roadmap for navigating various situations that may arise.

Limit Your Personal Liability

A well-drafted operating agreement can establish the LLC as a separate legal entity and help limit the personal liability of its members. The operating agreement should clearly state that the LLC’s debts and liabilities are separate from those of the members. This is important for shielding your personal assets from the LLC’s creditors.

In summary, an operating agreement is essential for clarifying the complex relationship between members in an LLC. It provides guidance for handling a multitude of situations that can influence the success and direction of your business. Creating a comprehensive operating agreement is one of the most important steps you can take to legitimize your LLC.

Key Components of an LLC Operating Agreement

As an owner of an LLC, you should create a comprehensive operating agreement to establish rules and procedures for your business. An operating agreement is a legal document that outlines the ownership, structure, and rules of your LLC. Some of the key components to include in an operating agreement are:

Ownership details

Specify the owners (referred to as members) of the LLC, their ownership percentages, rights and responsibilities. List the initial capital contributions of each member. Define the process for transferring membership interests if a member leaves the LLC.

Management structure

Define who will manage the day-to-day operations of the business. Will the LLC be member-managed, where all members participate in managing the company? Or will it be manager-managed, where certain members or non-members are appointed as managers? Specify the responsibilities and duties of managers.

Decision making

Explain how major business decisions will be made. For example, determine what percentage of member votes are needed to approve key decisions like amending the operating agreement, merging or dissolving the LLC, approving budgets, etc.

Capital contributions

State each member’s initial capital contribution, whether cash, property, or services. Also specify if additional capital contributions may be required in the future and how they will be determined. Define the consequences if a member fails to make the required contribution.

Profit and loss distribution

Specify how profits, losses, and distributions will be allocated among members, which is usually based on the ownership percentages. Define the distribution schedule, such as annually, quarterly or monthly.

Resolution of disputes

Include provisions for resolving any disputes among members or between members and managers in a constructive manner. You can specify a mediation and arbitration process to resolve conflicts internally before going to court.

The operating agreement establishes the ground rules for your LLC and helps avoid confusion and disputes down the road. Be sure to consult an attorney to ensure your agreement includes all necessary provisions and complies with your state’s laws. An airtight operating agreement will provide stability and help your business operate efficiently.

Creating Your Own LLC Operating Agreement

Once you have established your LLC, creating an operating agreement is one of the most important steps you can take to properly structure your company. An operating agreement outlines the ownership interests, management responsibilities, and financial obligations of the members in your LLC.

What to Include

The specific items to incorporate in your operating agreement will depend on your business and state laws, but there are several key provisions to consider:

- Ownership interests. Clearly define the ownership percentages of each member. Specify whether ownership interests can be transferred or sold to third parties.

- Management structure. Determine the management structure of your LLC, such as member-managed or manager-managed. Outline the specific managerial responsibilities and voting power of each member.

- Distribution of profits and losses. Establish how the profits and losses of the LLC will be allocated to each member based on their ownership stake.

- Contributions of capital. Record the initial capital contributions of each member and specify whether additional contributions may be required in the future.

- Resolution of disputes. Incorporate a procedure for resolving any disputes that arise between members in a constructive manner. You may specify that disputes will be handled through mediation or arbitration before going to court.

- Buyout/withdrawal of members. Outline the events and procedures that would trigger a member’s withdrawal from the LLC, such as death, bankruptcy, or desire to sell their interest. Establish a buyout agreement to govern the terms of a member’s exit.

- Amendments. Determine the voting threshold required to amend the operating agreement, such as a unanimous vote or two-thirds majority. Amendments should be made in writing and signed by all members.

By crafting a comprehensive operating agreement, you can help avoid confusion and conflicts among members down the road. Be sure to consult an attorney to ensure your agreement complies with your state’s LLC laws. With an airtight operating agreement in place, your LLC will be well-positioned for success.

LLC Operating Agreement FAQs

As a business owner, you likely have many questions about LLC operating agreements. Here are some of the most frequently asked questions and their answers:

An LLC operating agreement is a legal document that outlines the ownership, structure, and rules of your limited liability company (LLC). It establishes the rights and responsibilities of each LLC member and provides guidance for the organization and operation of your business. While operating agreements are not required by most states, having one in place is highly advisable to clarify expectations and avoid potential disputes.

You can create an LLC operating agreement yourself using templates and examples online. However, for more complex agreements or if you want to ensure compliance with your state’s laws, it is best to have an attorney draft or at least review the document. An attorney can customize the agreement to your specific needs and help you avoid missing any important details.

Conclusion

In closing, taking the time to create an operating agreement for your LLC ensures your business is set up for success. As the owner, you should make this important document a priority in the early stages of your company’s formation. With a carefully constructed operating agreement guiding your LLC, you will have an invaluable resource to reference that clearly defines all aspects of operations and provides protection in the event issues arise. Moving forward with a solid foundation and clear plan through an operating agreement leads to a promising future for your business.

Disclaimer

The information and services on this website are not intended to and shall not be used as legal advice. You should consult a Legal Professional for any legal or solicited advice. While we have good faith and our own independent research to every information listed on the website and do our best to ensure that the data provided is accurate. However, we do not guarantee the information provided is accurate and make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information on the Site. UNDER NO CIRCUMSTANCES SHALL WE HAVE ANY LIABILITY TO YOU FOR ANY LOSS OR DAMAGE OF ANY KIND INCURRED AS A RESULT OR RELIANCE ON ANY INFORMATION PROVIDED ON THE SITE. YOUR USE OF THE SITE AND YOUR RELIANCE ON ANY INFORMATION ON THE SITE IS SOLELY AT YOUR OWN RISK. Comments on this website are the sole responsibility of their writers so the accuracy, completeness, veracity, honesty, factuality and politeness of comments are not guaranteed.

So friends, today we talked about What Is an LLC Operating Agreement, hope you liked our post.

If you liked the information about What Is an LLC Operating Agreement, then definitely share this article with your friends.